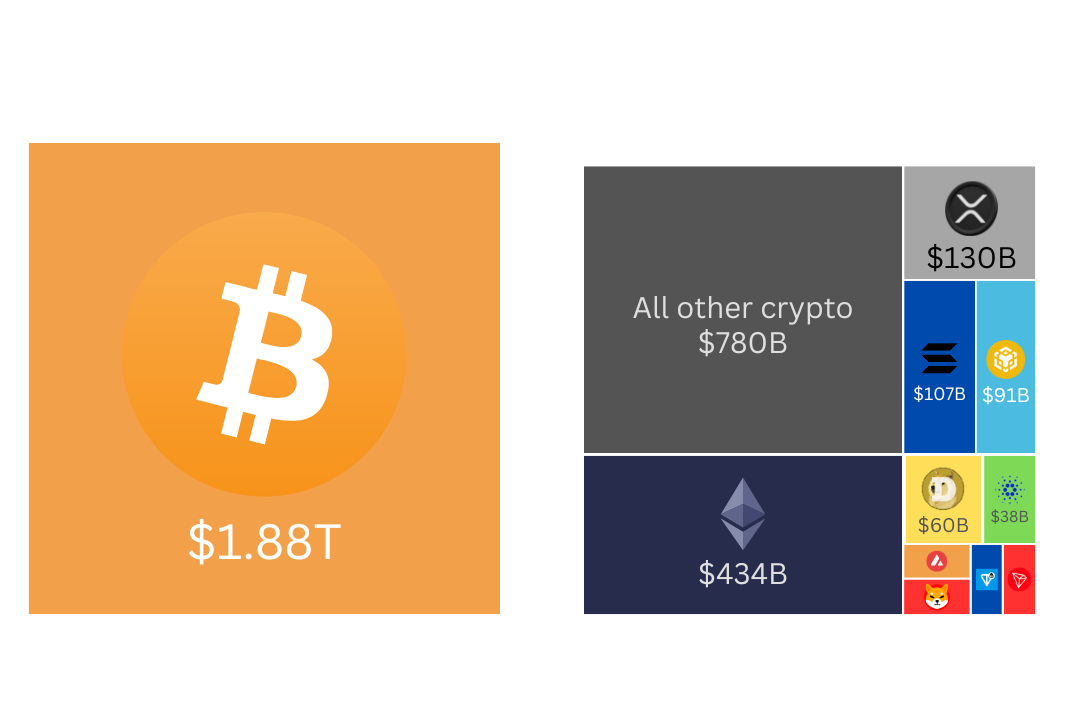

The cryptocurrency market has seen extraordinary growth over the past decade, catapulting from a niche concept to a trillion-dollar industry. As of now, Bitcoin has hit an all-time high of $100,000, solidifying its position as the king of crypto with a market cap of $1.88 trillion. This accounts for over 50% of the entire cryptocurrency market, a dominance that has ebbed and flowed over the years.

Bitcoin’s Market Cap Dominance: A Historical Snapshot

In its early days, Bitcoin was nearly synonymous with the crypto market, commanding over 90% market share in 2013. However, with the rise of altcoins like Ethereum, Solana, and newer entrants like Toncoin and Pepe, Bitcoin's dominance has fluctuated, dipping below 40% during the 2017 ICO boom. Today, as the total crypto market cap hovers around $3.62 trillion, Bitcoin has regained its strength, firmly holding 52% dominance, outshining all other coins combined.

New Faces in the Crypto Top 10

The crypto top 10 is always dynamic, reflecting innovation and investor sentiment. This year, we’ve seen Toncoin (TON), a blockchain developed by Telegram, enter the top ranks alongside the meme-fueled Pepe (PEPE). These coins highlight the evolving landscape, where technological potential and community-driven narratives play significant roles in valuation.

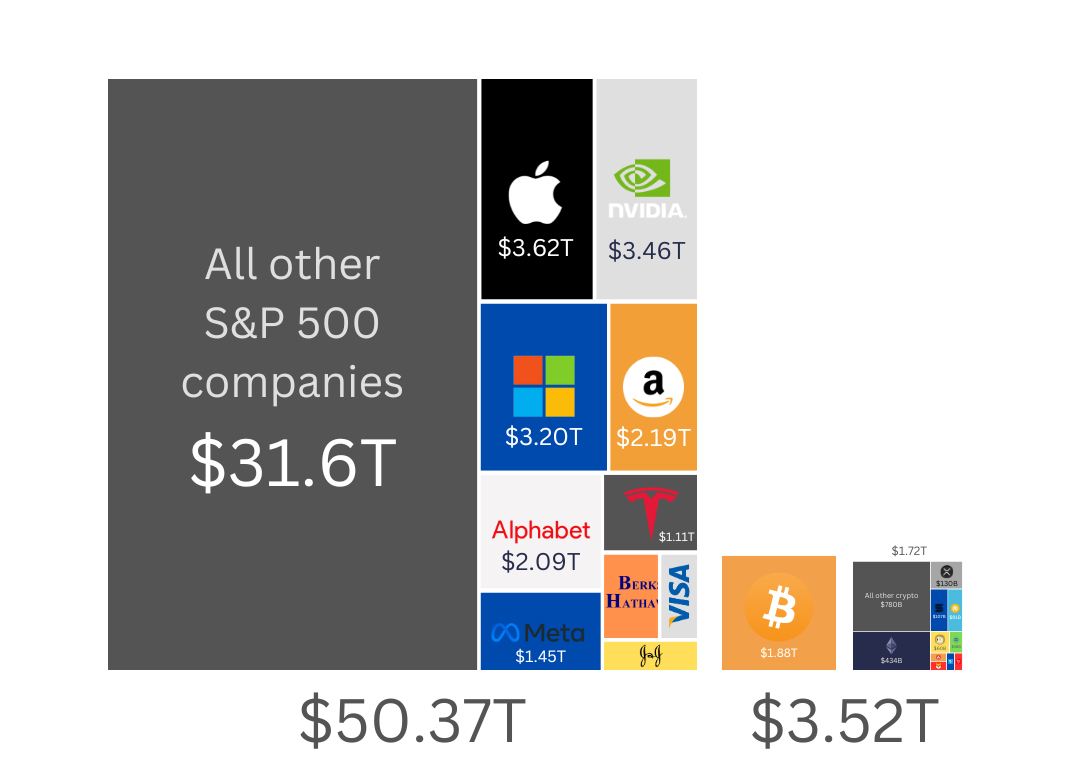

Comparing Crypto and the S&P 500

While the entire crypto market cap stands at $3.62 trillion, the S&P 500 dwarfs it with a staggering $50.37 trillion. The top 10 S&P 500 companies alone, including Apple ($3.62T), Microsoft ($3.20T), and Amazon ($2.19T), command more than the entire crypto market combined.

Crypto vs. S&P 500: A Different Ball Game

Investing in crypto is not for the faint-hearted. The market is known for its extreme volatility, with daily swings often exceeding 10%, compared to the relatively stable S&P 500, which typically moves less than 2% on a given day.

However, the high risk, high reward nature of crypto has lured investors looking for outsized returns. In contrast, the S&P 500 offers long-term stability, with consistent growth underpinned by the U.S. economy's strength. Diversification within the S&P 500 provides a safety net against single-company risk, whereas crypto investments often hinge on speculative hype and innovation cycles.

The crypto market cap may still trail far behind the S&P 500, but its growth trajectory suggests it’s a force to be reckoned with. Bitcoin’s resurgence in dominance, the rise of innovative coins, and the stark differences in investment dynamics all highlight the unique opportunities and challenges in this space.

Whether you’re a seasoned investor or a curious onlooker, understanding these dynamics is crucial to navigating the worlds of crypto and traditional markets effectively.

To my readers: I want to be transparent—yes, I use ChatGPT to help find relevant sources, refine analysis, and polish spelling and grammar. However, the ideas, visuals, and content are entirely my own work.